ASSA - English

ASSA: Becoming a Complete Logistics Company

Disclaimer: We are long ASSA

Summary

· ASSA is a diversified transportation service company offering B2B car rental service, used vehicles, car auction marketplace and delivery service.

· They have increased their revenue over the least 5 years by 14% CAGR; 3 out of 5 business segments also grew by double digit

· We think ASSA is worth at least IDR 2000/share driven by:

o Strong structural demand supporting car rental business

o Supportive macro and customer behavioral conditions for used vehicles sales

o Rising eCommerce transactions to propel AnterAja’s growth

Business Overview

PT Adi Sarana Armada (IDX: ASSA) is a transportation service company in Indonesia. The company provides vehicle rental and driver services for corporations, freight transportation of goods, an online marketplace for used cars, a self-drive car sharing application and last-mile delivery service for eCommerce businesses. As of 2020, the company operates over 25000 vehicles and over 3900 drivers for over 1500 corporations in Indonesia.

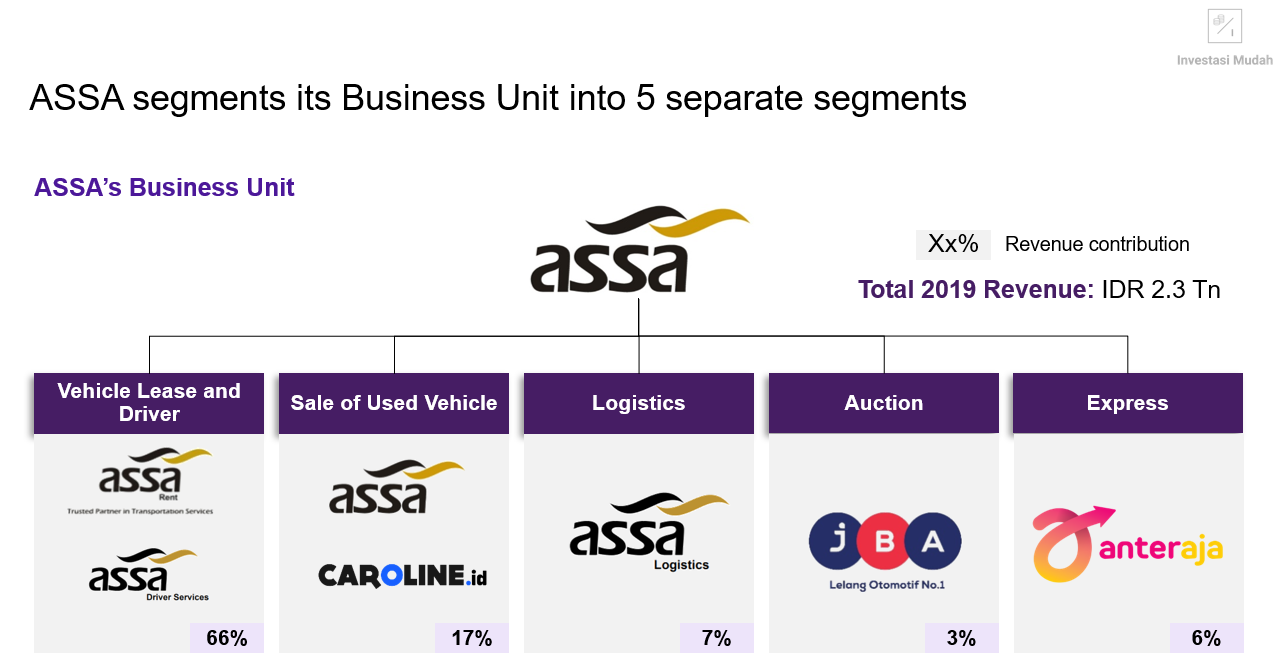

ASSA segments its business unit into 5 separate segments:

1. Vehicle Lease and Driver. The company provides B2B long-term vehicle rental services and provides contract drivers to B2B customers.

2. Sale of Used Vehicle. Through Caroline.id, an online car marketplace, customers can buy used cars with transparent prices and reliable quality.

3. Logistics. The company provides freight forwarding services using a pick up truck, blind van or container.

4. Auction. Through JBA Bidwin Auction (JBA), the company manages an automotive auction for two-wheeled and four-wheeled vehicles.

5. Express. Through AnterAja, the company provides last-mile package delivery services.

Source: ASSA 2019 Annual Report

Financials: Firing in (Almost) All Cylinders

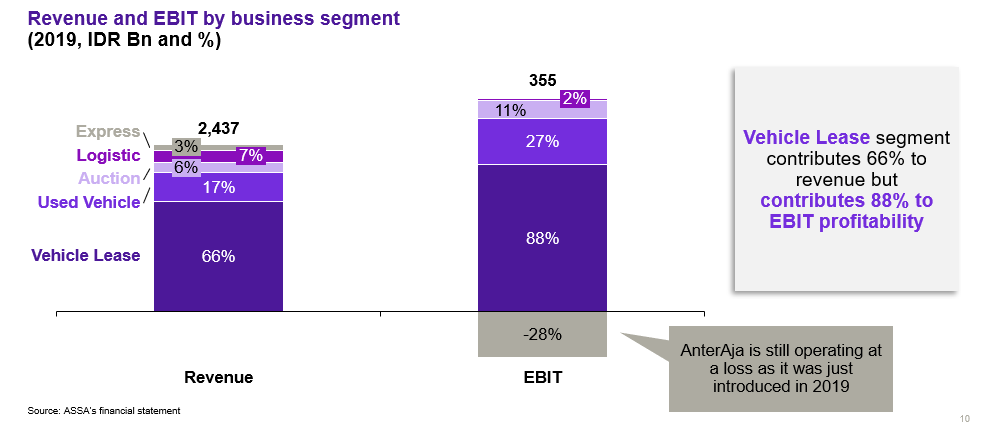

Over the last 5 years, ASSA’s revenue has grown at 14% CAGR primarily driven by strength in Vehicle Lease and Sale of Used Vehicle, growing at 13.4% and 17.4% CAGR respectively. Although ASSA seems to be a one-stop shop logistics solution company judging by their diverse services, the car rental business seems to be the main driver of the business by contributing to 66% of 2019 revenue. However, strong growth in other segments excluding Logistics led us to believe that car rental business will probably contribute a smaller percentage of total revenue for the upcoming years. Car rental business made up 70% of total 2015 revenue and we expect this number to keep decreasing going forward.

In regards to profitability over the last 5 years, ASSA has managed to increase gross profit margin from 29.8% in 2015 to 31.8% in 2019. However, EBIT margin has slightly dropped by 1.3% caused by an increased in G&A expenses.

After looking deeper into ASSA’s revenue and EBIT by business segment, we believe their operational performance is primarily driven by Vehicle Lease and Used Vehicle. Despite contributing to 66% of total revenue, Vehicle Lease segment made up 88% of total EBIT profitability. Thus, we think ASSA is using cash profits from their Vehicle Lease Segment to fund and grow business operations for AnterAja.

Investment Thesis

We believe ASSA is worth at minimum IDR 2000/share driven by the following 3 factors:

1. Strong structural demand supporting ASSA’s B2B car rental business

2. Supportive macro condition and behavioral change for ASSA’s used vehicle segment

3. Launch of AnterAja as the next growth driver for ASSA

1. Strong Structural Demand Supporting B2B Car Rental Business

ASSA’s Vehicle Lease and Driver Segment increased from IDR 975 billion in 2015 to IDR 1612 billion in 2019, implying a 13% CAGR. Meanwhile, the number of cars ASSA operates since 2015 has been growing at 10% CAGR until 2019 to reach 25,964 cars. It’s also worth noting that revenue from car rental business has been growing faster than number of cars available. Assuming all cars have 100% utilization rate, we can infer that ASSA were able to generate extra revenue per car in the last 5 years. Hence, ASSA’s clients may be subscribing to a more “up-scale” package where they choose to opt for more expensive car packages/contracts.

Before COVID-19 showed up, car rental business looks to be growing at double digit entering 2020 as Q1 2020 revenue grew 7.4% YoY to reach IDR 291 billion. However, the pandemic seems to have slightly affected revenue growth as Q2 2020 only grew 1% YoY and Q3 2020 revenue decreased 3% YoY. We believe that ASSA’s diversified customer base of big corporations have prevented revenue growth from declining more because these large corporations have ample cash flow to weather an economic downturn and are usually bound by a long term contract.

Source: ASSA’s annual report, various equity research reports, CapitalIQ

So, what might contribute to ASSA’s revenue growth in their Vehicle Lease and Driver Segment? Well, renting a car is cheaper and significantly less complex financially and operationally for large corporates. For example, renting an Avanza for 5 years costs 8% cheaper than buying a new one. Renting also doesn’t include the intangible costs associated with owning a car such as loss time for maintenance, etc.

While 8% might not seem much at first glance, the cost reductions have big implications for large corporations and micro, small & medium enterprises (MSMEs). Large corporations are mature companies and find it difficult to grow. Thus, to focus on increasing their profitability, large corporations may find it cheaper to rent a car than to buy a car. On the other hand, MSMEs typically have revenues below IDR 2.5 billion per year and a new car can cost around 10% of their annual revenue. Renting a car gives MSMEs financial flexibility on their balance sheet to operate.

Source: CarMudi, desk research, companies’ annual reports, news site

2. Supportive Macro Condition and Behavioral Change for Used Vehicle Segment

Over the last 5 years, ASSA’s used car segment has grown at 17% CAGR driven by strong increase in number of cars sold. Car units sold have reached 4,270 in 2019, implying a 16% CAGR since 2015.

Source: Annual Report

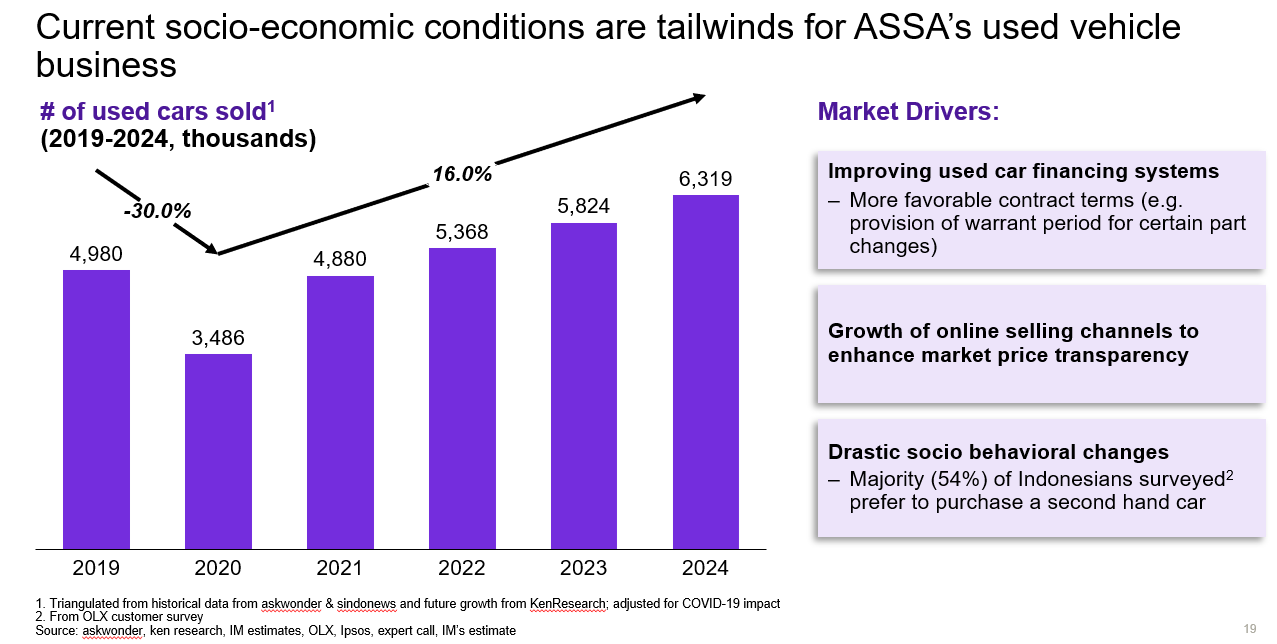

While we expect number of used cars sold to decrease 30% in 2020, we believe current socio-economic conditions are tailwinds for ASSA’s used vehicle business. First, Indonesia’s used car market are growing due to improving used car financing systems. Indonesians have a greater flexibility of financing terms from private financing companies. These private financing companies typically offer more flexible down payment options than do banks. In addition, current car financing market can get borrowers an approval in 3-7 days, allowing used car payments to be more convenient. Second, growth of online selling channels (e.g. Carmudi, Caroline-id) will enhance market price transparency as customers leverage these channels to make price comparisons. Lastly, 54% of Indonesians prefer to purchase a second-hand car, according to an OLX customer survey. With these 3 market drivers in mind and historical data from research outlets, we estimated number of used cars sold in Indonesia to reach 6.3 million in 2024.

3. Launch of AnterAja as the next growth driver for ASSA

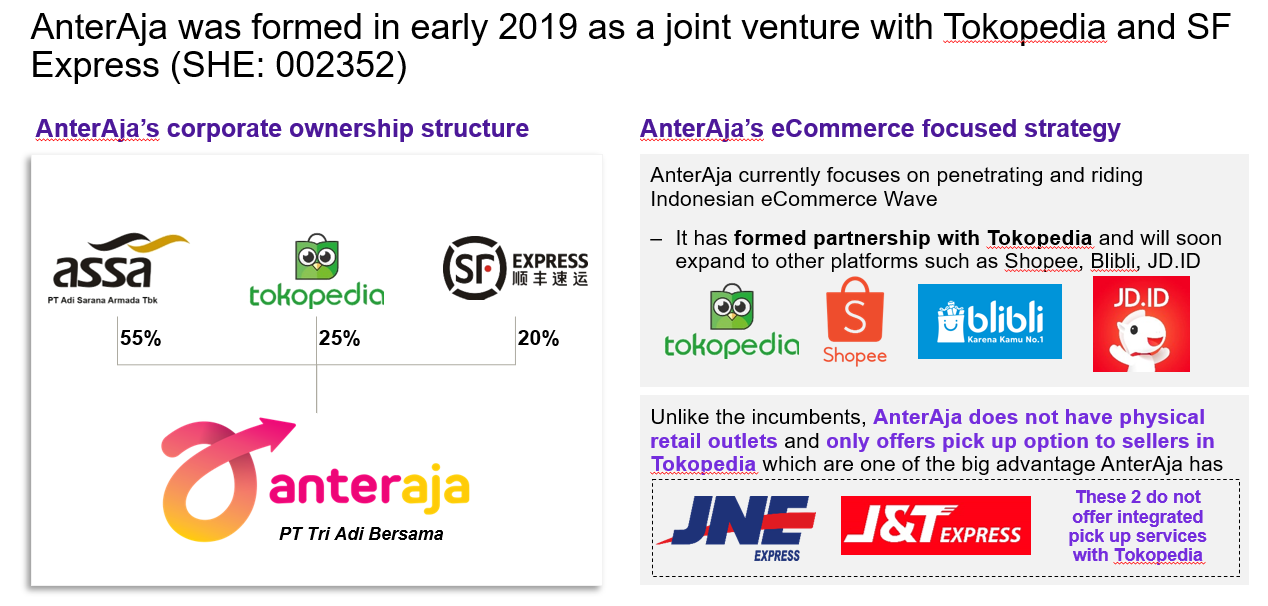

AnterAja, an online express logistic company formed in early 2019 as a joint venture with Tokopedia and SF Express, has the potential to grow due to their eCommerce focused strategy. AnterAja has formed partnerships with Tokopedia and other eCommerce marketplace platforms such as Shopee, Blibli, JD.ID and Bukalapak, to allow customers to use AnterAja for last-mile delivery services. Unlike express logistics incumbents, AnterAja does not have physical retail outlets and only offers pick up option for sellers in Tokopedia. Besides, since AnterAja can collaborate with ASSA to rent vehicles instead of purchasing vehicles for delivery, we believe this synergy will allow ASSA to expand aggressively as the new player in the courier market.

COVID-19 has accelerated Indonesia’s eCommerce adoption and we expect lasting adoption beyond the pandemic. Indonesia’s eCommerce Gross Merchandise Value (GMV) are expected to reach USD 83 bullion in 2025, a whopping 159% increase from 2020. Moreover, usage of eCommerce has doubled during the pandemic. While the eCommerce market is huge and fragmented, we believe the growing eCommerce transactions will propel AnterAja’s business.

AnterAja’s revenue has grown rapidly every quarter since its inception in March 2019. To put this growth into perspective, AnterAja contributed to 14% of ASSA’s total revenue in Q1 2020 compared to 3% in FY 2019 revenue!

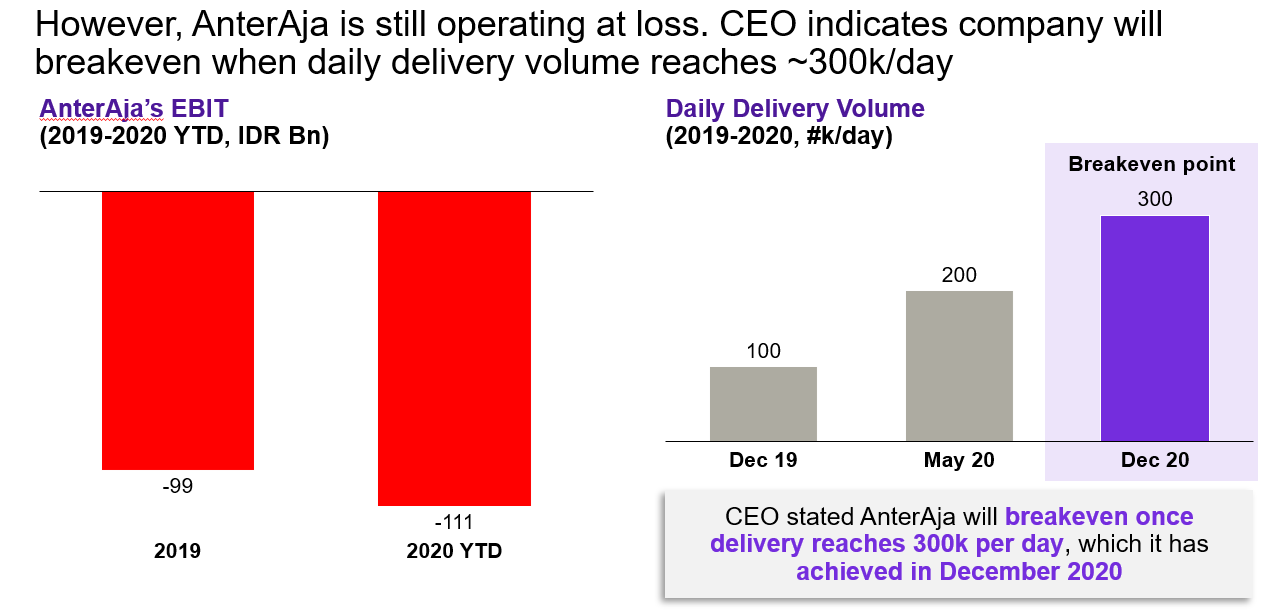

However, AnterAja is still operating at a loss at a delivery rate of 200k packages/day in May 2020. The company’s EBIT in 2019 and 2020 was IDR -99 billion and IDR -111 billion, respectively. AnterAja’s management has stated that they will breakeven once daily delivery reaches 300k, which they have achieved in December 2020.

We view ASSA’s expansion into the last mile delivery business positively as the company manages to reach breakeven point in December 2020, about two years after AnterAja’s inception. Compared to other ASSA’s business segment, we believe AnterAja has the lowest correlation to GDP growth and the highest growth potential. Considering majority of ASSA’s profitability still comes from Vehicle Lease Segment, ASSA could use profit from the car rental business to fund AnterAja’s growth and expansion.

Valuation

We value ASSA based on a DCF model, assuming 14% WACC, 1% terminal growth and 4 Bn shares outstanding. We arrived at our price target of IDR 2000/share after netting off IDR 11,012 billion of enterprise value with IDR 3,000 Bn of net debt to get an equity value of IDR 8,000 Bn.

Risks include: 1) weak economic conditions can adversely impact demand for car rental business and used vehicle, 2) increased competition from highly fragmented last-mile delivery market, 3) weak logistics infrastructure outside big cities may slow AnterAja’s expansion