DMMX - English

DMMX: Capturing the Growing Cloud Advertising Industry

Disclaimer: We are long DMMX

Summary

· DMMX is a digital advertising company focused on helping retailers target customers through digital trade marketing and cloud-based advertising platform

· They are targeting a massive cloud advertising market, with over 12 thousand screens and 74 thousand trade marketing users

· We think DMMX is worth around IDR 225/share driven by:

o Their revenue growth is promising as retailers continue to adopt digital advertising to increase customer engagement

o Introduction of smart detection points during pandemic lockdown has created an additional source of revenue for hardware sales

Business Overview

Digital Media Maxitama (IDX: DMMX) is a digital advertising company that offers digital trade marketing and cloud advertising exchange platform. DMMX provides hardware, operating systems, and the infrastructure for digital advertising. The whole infrastructure is end-to-end and can include source devices like computers, cables that distribute the signal and display screens.

Source: DMMX Annual Report

Surprisingly though, DMMX’s main revenue source (78% of 2020 revenue) came through its Trade Marketing segment with Pojok Bayar app. In collaboration with Sampoerna Retail Community, the app targets minimarkets and mom-and-pop stores under the Sampoerna Community. Customers can go to the minimarket and pay bills using the Pojok Bayar app. DMMX derives revenues from digital vouchers sold through the app and selling advertising slots.

Source: DMMX Annual Report

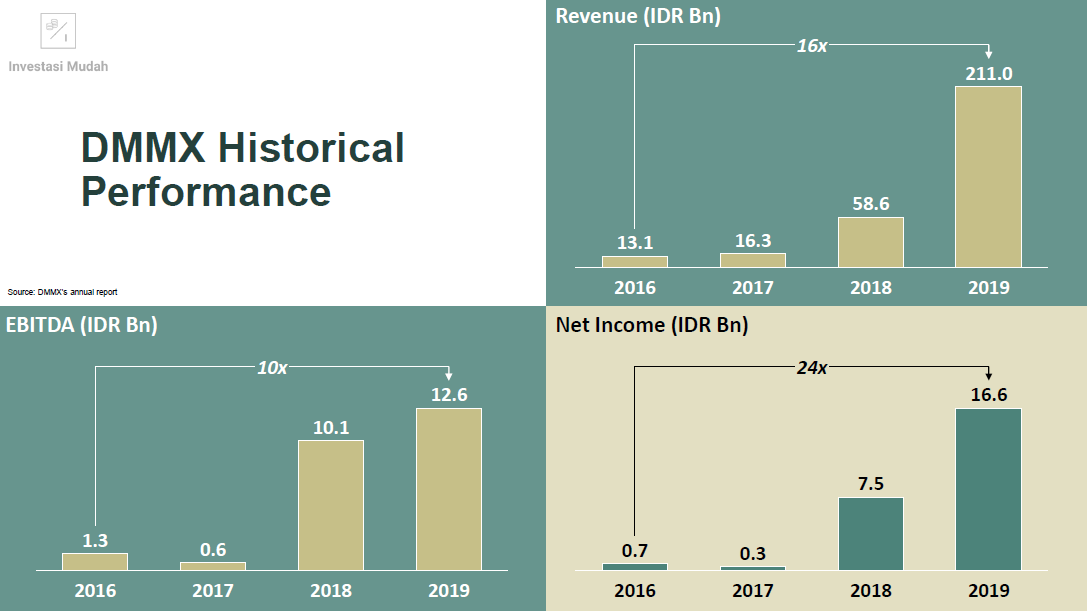

Financials: Strong Top-Line and Bottom-Line Growth

DMMX has grown revenues at 152% CAGR between 2016 and 2019, driven by trade marketing segment which grew at 482% between 2018 and 2019. It is already quite profitable with EBITDA and net income growing at a 112% and 194% CAGR respectively, from 2016 to 2019.

DMMX recently reported strong Q3 2020 results. They achieved strong top-line and bottom-line growth as 9M20 revenue reached IDR 347.6 billion (+270.4% YoY) and 9M20 net income reached IDR 24.9 billion (+235.7% YoY). The monstrous increase in revenue is primarily driven by Trade Marketing Segment, which contributed IDR 275.5 billion (+468% YoY). Pojok Bayar users increased 57% YoY to 74,078. In addition, total number of screens deployed increased 103.8% YoY reaching 12,823 screens covering 9373 (+96% YoY) advertising spots. You can find their Q3 reports in detail here.

Investment Thesis

We believe DMMX is worth IDR 225/share driven by 4 factors:

1. Massive growth in cloud advertising market

2. Growing digital adoption among retailers

3. Effectiveness of digital signage as an advertising media

4. Continued release of products signals an innovative management

1. Sizing Up DMMX’s TAM

Despite all the growth that DMMX has enjoyed financially, we believe the cloud advertising industry is still in its early innings.

The global cloud advertising market was valued at USD 150 billion in 2019 and is expected to reach USD 352 billion by 2025, implying a 15% CAGR. Technological advancements concerning the internet, combined with increasing commercial applications have shaped the evolution of cloud advertising.

Although North America is the largest market player in cloud advertising, Asia Pacific market is expected to grow the fastest.

In Indonesia, DMMX only covers 9373 retail stores out of 3 million available, equivalent to 0.3% market share, leaving plenty of room for growth.

Our research led us to believe that there is not a lot of public plug and play digital advertising companies in Indonesia. So, if you want to invest in digital advertising companies in Indonesia Stock Exchange, look no further than DMMX.

2. Growing Digital Adoption Among Retailers

Today’s retail companies are undergoing massive changes in their technology and marketing approaches. These changes ride the wave of Industry 4.0 - the automation of traditional industrial practices, using advanced technologies that capture, optimize and deploy data - and companies have to understand the value of these technologies when they confront the new landscape.

Increasing internet penetration has forced retailers to adopt technology in their marketing approaches. Big retail companies such as Alfamart and Indoritel, have stated publicly that they have to adapt to the digital age by taking advantage of consumer data.

In recent years, retail and consumer goods companies focused primarily on digitizing their customer interface. For example, KFC has been developing technology to facilitate orders online through their website and app.

Now, companies must think about ways to integrate their systems and their technology infrastructure. Retail companies can start by personalizing customer offerings through digital marketing and adopting data and analytics as a core capability.

As we’ve touched before on the DMMX’s financial performance, the increased adoption of digital screens, physical advertising spots, and DMMX’s Pojok Bayar app have shown evidence of these massive shifts in digital advertising.

Retailers are adopting digital technology in their operations to increase brand awareness. As a digital technology provider, DMMX is poised to benefit from this trend.

3. Effectiveness of Digital Signage as an Advertising Media

Digital signage has become an essential communication tool in our lives. As a concept, digital signage is extremely effective because it allows you to cater to your audience where they are with the info they want.

Study shows that digital signage has a higher amount of consumer reach than does internet advertisements. Moreover, outdoor media has been touted as one of the most effective media used by brands to build rapport with consumers. Nielsen Media estimated that Indonesians spend 4.5 hours outside their home on weekdays. Therefore, it is no surprise that the probability an individual can recall an ad in digital signage is high.

Benefits of Digital Signage as an Advertising Media:

4. Continued Release of New Product Signals an Innovative Management

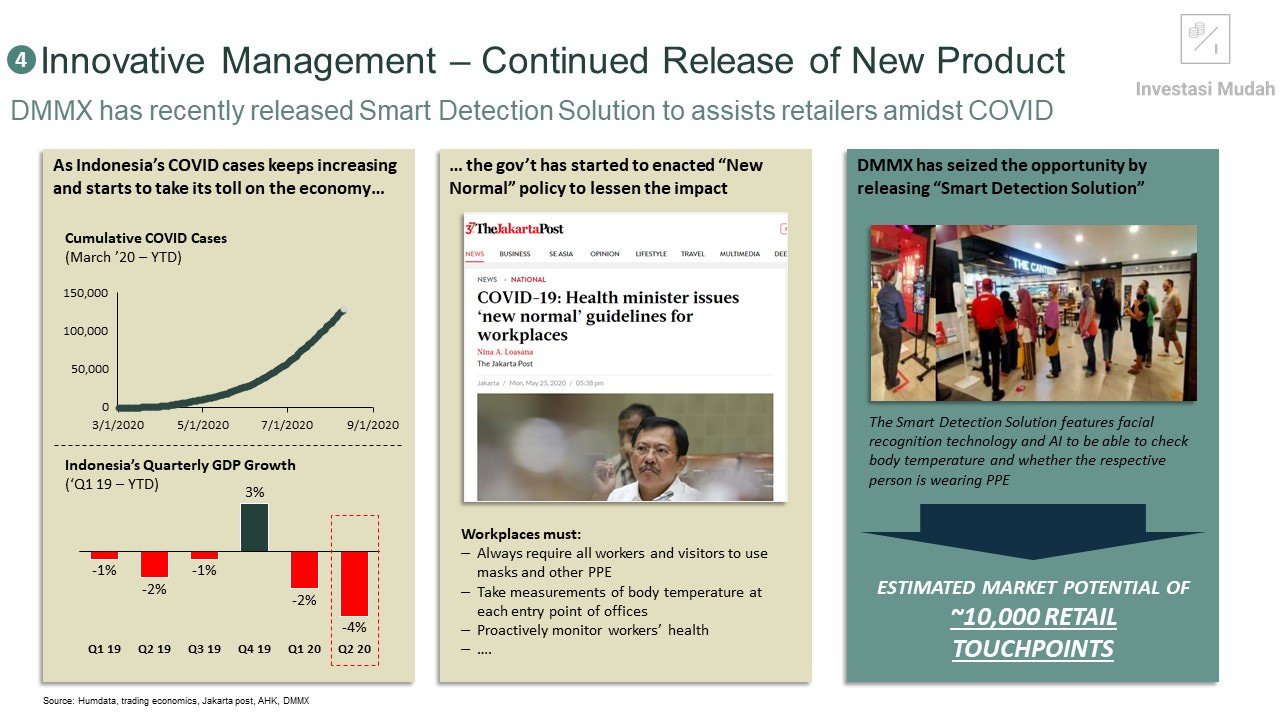

COVID-19 cases in Indonesia keeps increasing exponentially since March 2020. As a result, Indonesia’s Q2 2020 GDP dropped 4% MoM. To counter this, the government implemented a “New Normal” policy to revive the economy while attempting to minimize the impact of COVID-19 through workplace regulations such as personal protective equipment requirements and body temperature checks.

DMMX has then seized this opportunity to deploy 10,000 smart detection points. Armed with facial recognition technology and artificial intelligence, the smart detection point can determine body temperature and scan mask usage.

This smart detection solution supposedly can control number of visitors and streamline the onboarding process required for retail stores to function efficiently and safely.

We believe these smart detection points will bring in more hardware sales for DMMX in the foreseeable future.

Valuation

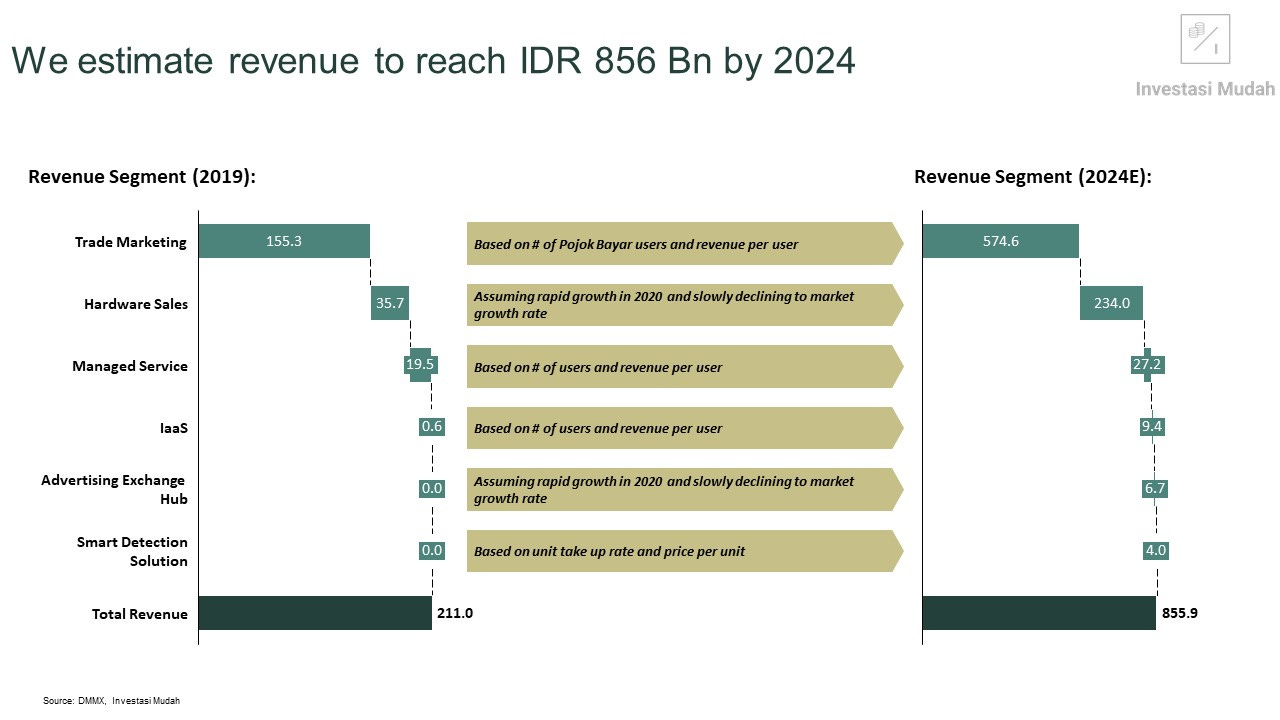

Our IDR 225 price target is based on our DCF analysis, assuming 2024 revenue of IDR 856 billion, implying a 32% CAGR between 2019 and 2024. At current price of IDR 450/share, current valuation seems stretched and upside seems limited, but the market opportunity is simply too great in our view to sell DMMX as we want to see our investment thesis played out.

Risks include increased competition from other apps that allow users to pay bills, the potential that retailers could seek to use other forms of advertising media and slower economic recovery for pandemic-impacted retailers. Hardware sales might be negatively impacted as businesses will be bootstrapped for cash if the pandemic forces prolonged stay-home orders. On the other hand, we believe Pojok Bayar usage will still grow despite the pandemic because they provide essential services such as phone credits and electricity bills.