PRDA - English

PRDA: Leading Clinical Lab Player in a Growing Market

Disclaimer: We are long PRDA

Summary

· PRDA is a leading clinical laboratory player in Indonesia

· They have massively increased their profitability margin over the least 5 years

· We think PRDA is worth around IDR 3400/share driven by:

o Attractive private clinical lab market due to favorable macroeconomic trends

o Strong brand equity in clinical laboratory

o Strong market penetration due to large laboratory network

o Ability to achieve economies of scale through “hub and spoke” model

o Comprehensive offerings targeting multiple customer segments

Business Overview

Prodia Widyahusada (IDX: PRDA) operates a private chain laboratory clinic which provides laboratory and panel test services; and other diagnostic support services. As of 2020, the company operates through a network of 151 branches and outlets across 34 provinces in Indonesia.

Source: PRDA 2019 annual report

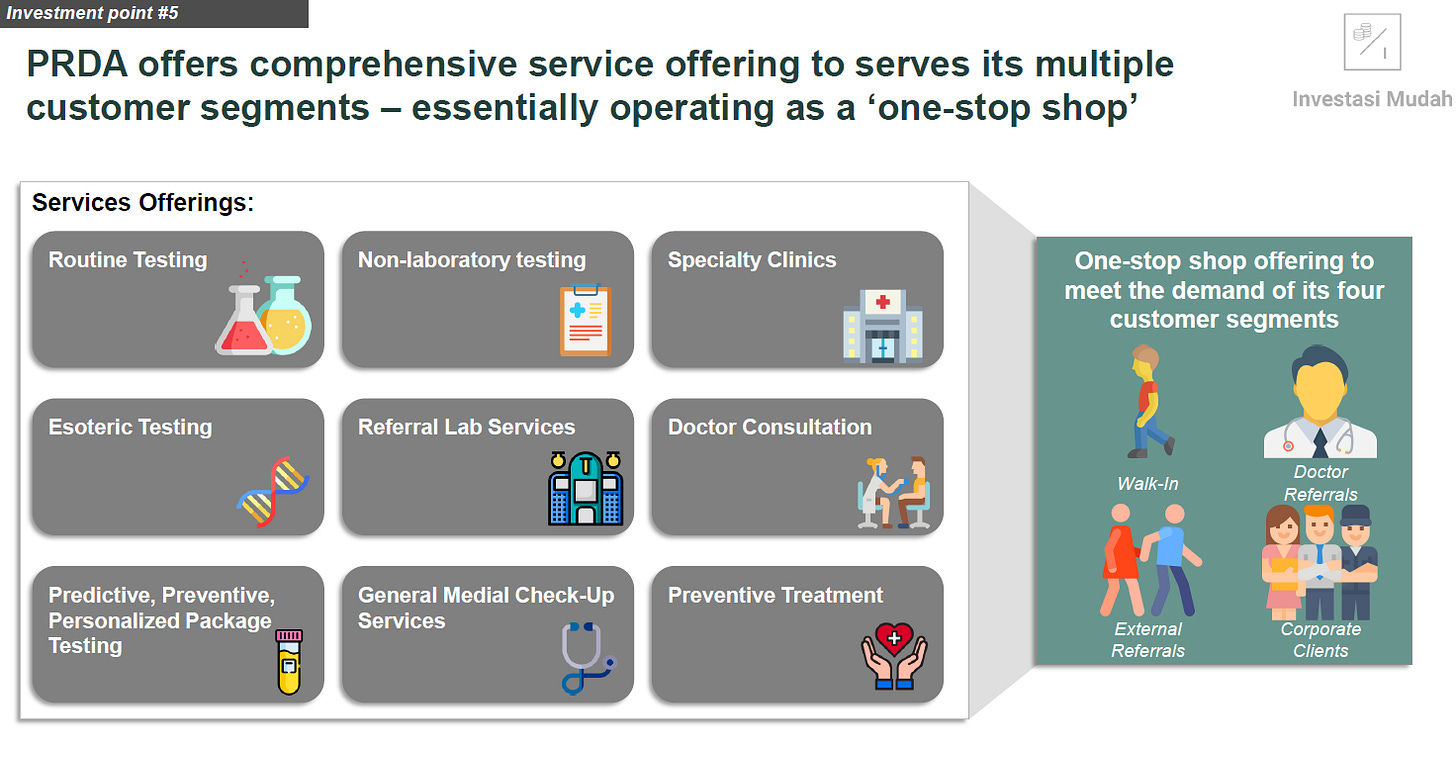

Prodia segments their business into 4 types of customers:

1. Walk-in Customer. Prior to visiting the company’s clinical lab, walk-in customers must consult with a doctor in one of Prodia’s facilities to get admitted.

2. Doctor Referral. Customers can use a referral from an external doctor or clinic to get healthcare services with Prodia.

3. Third Party Reference. External hospitals, clinics or other laboratories can refer customers to Prodia for some specific type of examination.

4. Corporate Client. Employees of private and state-owned companies who need to do medical check-up pursuant to the prevailing law and regulations.

Source: PRDA 2019 Annual Report

Financials: Improving Profitability

Prodia has grown revenues at 8.7% CAGR between 2016 and 2019, driven by External Referrals segment which grew at 18.1% in the same time period. Moreover, EBITDA has been growing at 21.5% CAGR between 2016 and 2019, suggesting an improvement in operational efficiencies. As a result, free cash flow has grown at 80% CAGR from 2016 to 2019, reaching IDR 259 billion or equivalent to 15% of 2019 revenue.

Source: PRDA’s financial statements

Prodia has significantly improved their EBIT margin as percentage of revenue in the last 5 years, from 6.7% in 2014 to 12.2% in 2019. The primary drivers of the profitability improvements were a decrease in COGS margin by 3 percentage points (p.p.) and a decrease in operational expenses margin by 3 p.p.

Investment Thesis

We believe Prodia is worth IDR 3414/share driven by 5 factors:

1. Attractive and rapidly growing market size

2. Strong brand equity

3. Strong market penetration due to its large network and numerous location points

4. Ability to achieve economies of scale

5. Superior product offerings targeting multiple customer segments

1. Attractive and rapidly growing market size

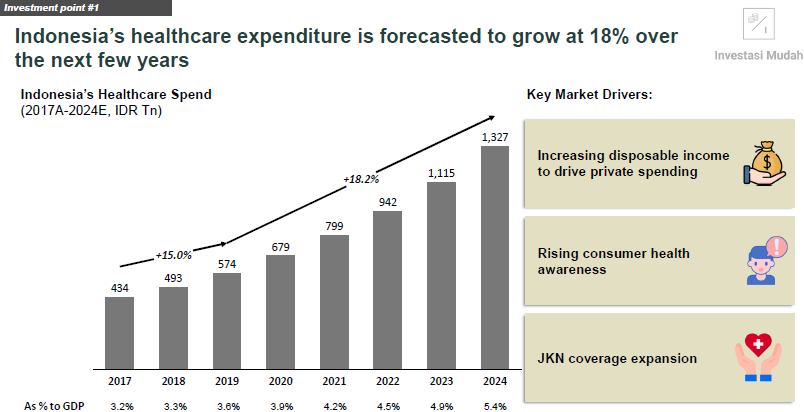

Indonesia’s healthcare spending is poised to grow at 18% from 2019 to 2024, reaching IDR 1,300 trillion. Subsequently, Indonesia’s healthcare spend as a percentage to GDP is also expected to increase from 3.6% to 5.4%.

The increase in healthcare spending is driven by 1) increasing disposable income to drive private spending 2) urbanization and an increase of lifestyle-related diseases such as cancer and diabetes are raising health awareness among consumers and 3) government implementation of universal health coverage to make healthcare more affordable.

Source: Fitch BMI

More importantly, the clinical lab market, a segment which Prodia operates in, is expected to grow at 10% CAGR from 2019 to 2024, leaving Prodia a total available market of IDR 53 trillion in 2024. In reality, though this figure seems a bit inflated as Prodia cannot realistically capture the entire market. Let’s calculate the serviceable addressable market.

Source: Frost & Sullivan, Investasi Mudah’s Forecast

The clinical lab market is divided into public market and private market. The private market is further divided into clinics that offer routine checkups, hospitals that offer specialized services and private independent labs which receive samples from other health clinics and hospitals for analysis.

Prodia operates in the private independent labs market, which is expected to grow at 11% CAGR from 2019 to 2024, according to Frost & Sullivan. This leaves Prodia a serviceable addressable market of IDR 8.3 trillion by 2024.

We believe the primary drivers of the clinical lab market are 1) Increasing demand for private lab testing due to public labs’ over capacity 2) Rising incidence of chronic diseases driven by urbanization and rise in obesity rates 3) Rising awareness of preventive healthcare attitude and 4) Introduction of new specialized tests

Source: Frost & Sullivan, Investasi Mudah’s Forecast

2. Strong brand equity

In the private clinical lab industry, where relationship with patients is critical for recurring revenue, Prodia has the strongest brand recognition when compared to their competitors. They won the top branding awards in their industry for the last 5 years. These awards take into account top of mind awareness and product inventions. Prodia’s strong brand recognition should come as no surprise considering their management team’s deep background in pathology.

Source: Top Brand Award

3. Strong market penetration thanks to their large network and numerous location points

Compared to their peers, Prodia’s network is 6-7 times larger than its closest competitor, which is Kimia Farma. With over 287 clinical outlets, Prodia is clearly the market leader in terms of laboratory network.

Geographically, majority of Prodia’s sales came from labs in key urban areas such Jakarta and other cities on Java. Prodia’s laboratory network is strategically attractive because people who live in urban areas are more likely to spend more on health care.

Prodia’s management has stated in 2019 annual report that one of the company’s growth strategies is to expand its network of outlets in Indonesia. Since Prodia has many outlets in Java (71% of total outlets), we believe the opportunity for expansion lies in the outer islands. At 2019 D/E ratio of 2.9%, Prodia is more than capable to execute their strategy by taking on more debt.

Over the past 5 years, Prodia has added more than 21 outlets while also increasing revenue per outlet from IDR 4.5 billion in 2015 to IDR 6.1 billion in 2019.

4. Ability to achieve economies of scale

Prodia employs a scalable “hub and spoke” model centered around the Prodia National Reference Laboratory (PNRL) in Jakarta as the national hub and four Regional Reference Laboratories (RRL) in Medan, Surabaya and Makassar as the smaller hubs. These RRLs have a centralized IT database on other smaller Prodia Health Care Clinics (PHC). So, any customer can perform tests in these clinics and have the sample sent from PHC to the regional labs for further evaluation.

The “hub and spoke model” results in cost efficiencies because Prodia can set out more PHCs, which typically cost lower to build than RRL due to less extensive testing equipment, in underpenetrated regions to get more samples and deliver the samples to either PNRL or RRL.

It’s clear that Prodia has developed one of the best “hub and spoke” model evident by their cost efficiencies. Over the last 5 years, EBIT margin has increased by 5 percentage points. This strategy gives Prodia a significant competitive network advantage going forward. Due to this incredible hub and spoke model, Prodia can be more cost effective with increasing outlets.

Prodia relies on their “hub and spoke” model to scale while achieving operational efficiencies. Spokes will increase test volumes in remote areas and feed the results to the hub for further analysis.

5. Superior product offerings targeting multiple customer segments

Prodia provides a comprehensive list of services throughout its laboratory network to meet the demand of its four customer segments. The company aims to operate as a ‘one-stop shop’ for customers by providing consultation and analysis of examination results. It’s also worth noting that PNRL is the only Indonesian Laboratory that qualified for CAP accreditation. To qualify for the CAP accreditation, laboratories are evaluated for providing a thorough and comprehensive tests for their patients. Laboratories under CAP accreditation also get access to exchange ideas with other world-renowned laboratories and laboratory professionals.

COVID-19 Impact on Prodia’s Financial Performance

Shutdowns caused by COVID-19 has adversely affected Prodia’s operations. Patients were less likely to do walk-in visits unless absolutely necessary. In addition, companies were not hiring, so they have less referrals to send their employees over to Prodia’s laboratories.

For 6M20, revenue went down 17% YoY and EBIT decreased 150% YoY. The decrease is primarily driven by an abysmal second quarter performance as revenue and EBIT plummeted 34% and 338%, respectively.

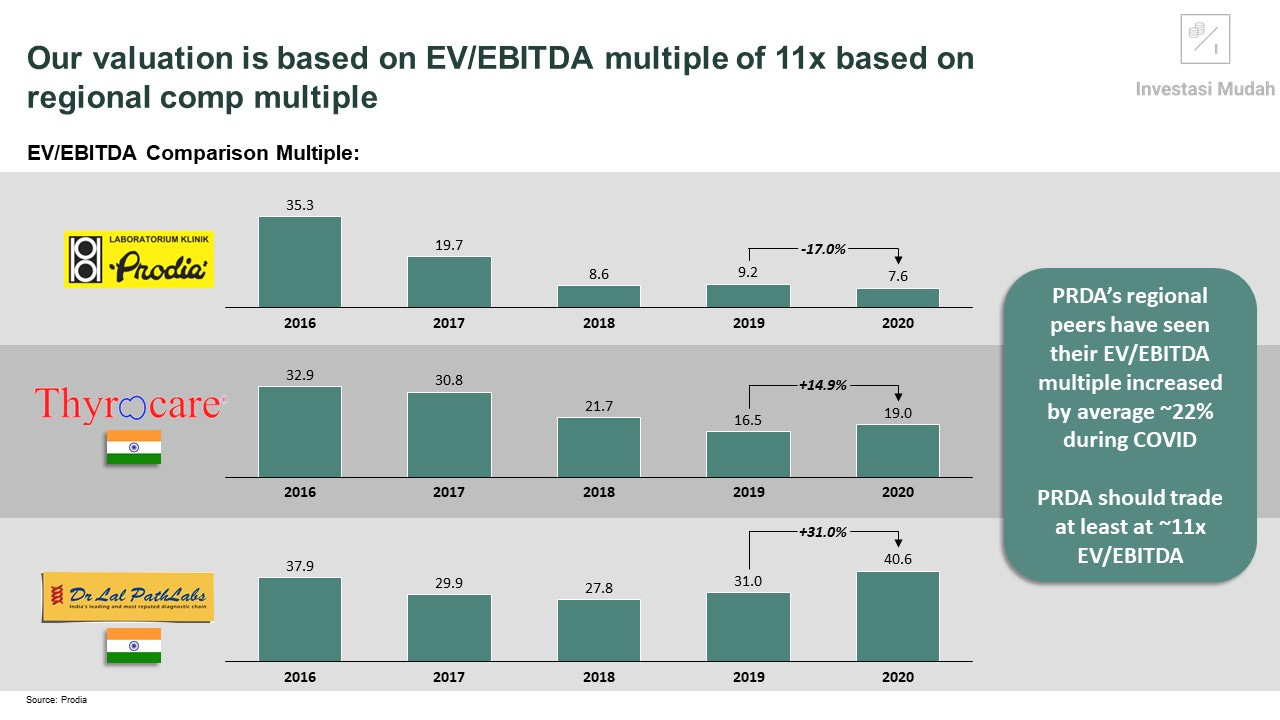

Valuation

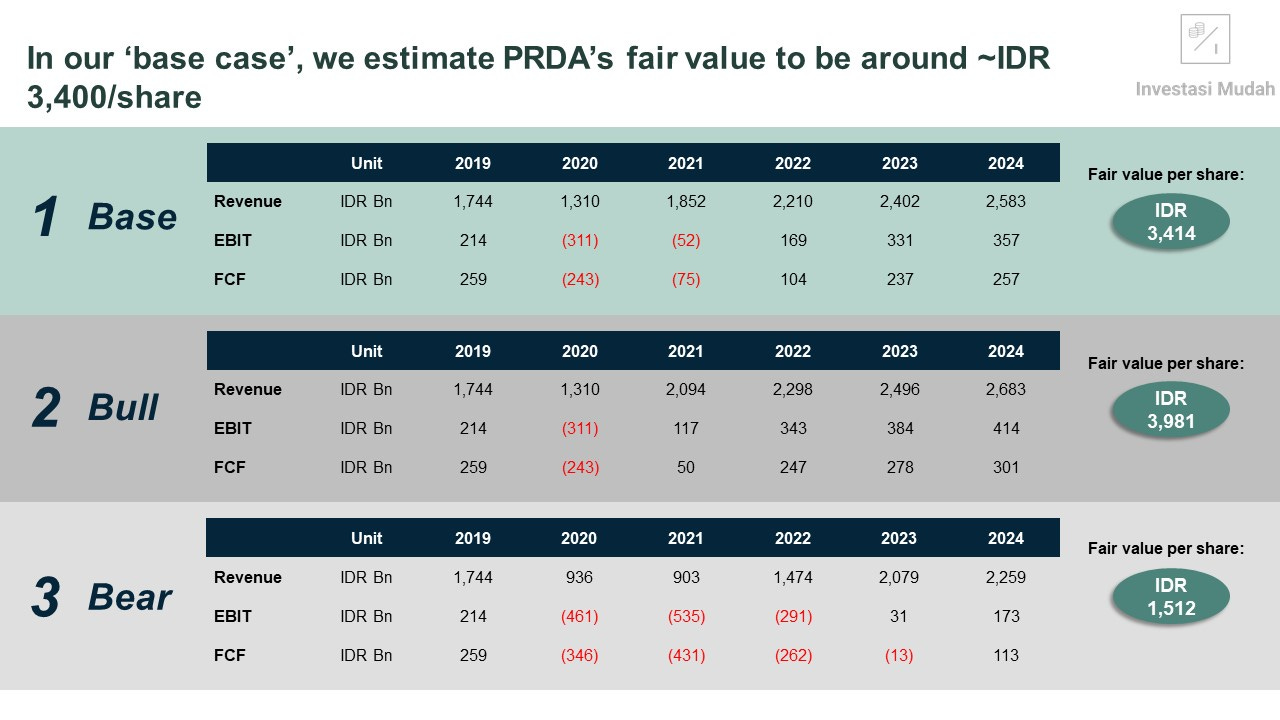

Due to how significant the pandemic’s impact is on Prodia’s operations, we model three scenarios, which are all based on how quickly Indonesian economy recovers from COVID-19 and how early will we get a vaccine.

Our base case, where we predict Prodia will generate positive free cash flow by 2022, yields a fair value of IDR 3,400/share. While our bullish case, where Prodia generates positive free cash flow by end of next year, yields a fair value of IDR 3,981/share. Lastly, our bearish case, where we think Prodia will only generate positive free cash flow by 2024, yields IDR 1512/share.

Risks include: 1) slower economic recovery and slower vaccine rollout, 2) failure to improve operating efficiencies, 3) delays in laboratory expansion projects, 4) inability to maintain brand recognition and 5) increased competition in basic routine tests segment